Active ETFs in Canada, Too Many, Too Soon?

An explosion of products, but assets lag.

Much like basketball, the walkie-talkie, and Drake (the rapper), exchange traded funds (ETFs) are among the innovations that originated in Canada before proliferating globally. The first ETF, known as the Toronto 35 Index Participation Units (TIPs), was launched on the Toronto Stock Exchange in 1990. This pioneering financial product paved the way for the introduction of the first U.S. ETF, the SPDR S&P 500 ETF Trust (SPY), in 1993. Today, there are approximately 1,500 ETFs listed in Canada and over 27,000 globally, according to Morningstar’s data.

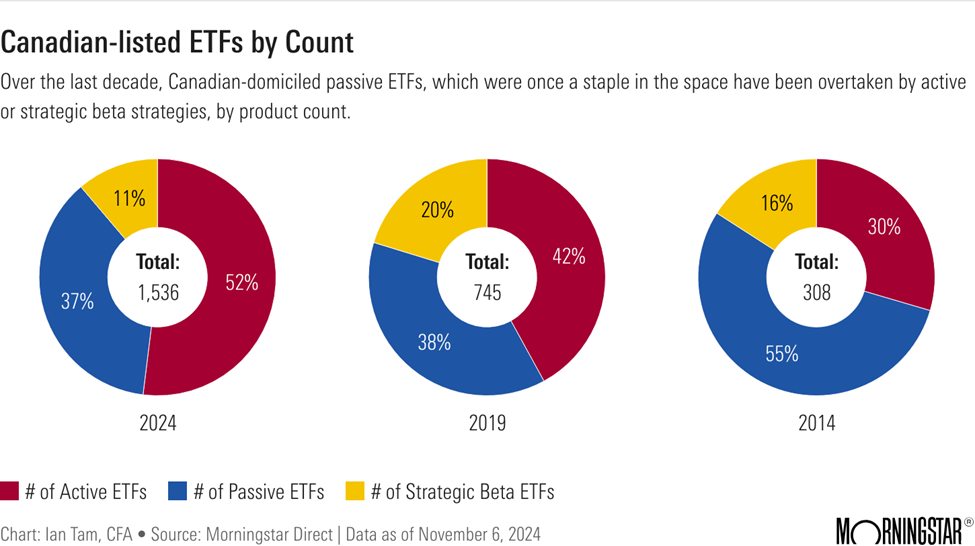

The past decade’s evolution of ETFs has been marked by significant growth, with assets now making up over half a trillion Canadian dollars. Initially, ETFs were predominantly passive investment vehicles, designed to track the performance of a market cap weighted index. Their appeal lay in their simplicity, transparency, and cost-effectiveness. However, the landscape has shifted considerably in recent years with the rise of actively managed ETFs. These funds, managed by professional portfolio managers who make investment decisions with the goal of outperforming a benchmark (either by security selection or asset allocation), have seen rapid proliferation. In fact, by count, actively managed ETFs make up more than half of the ETFs listed in Canada today, a stark contrast to just a decade ago when the opposite was true.

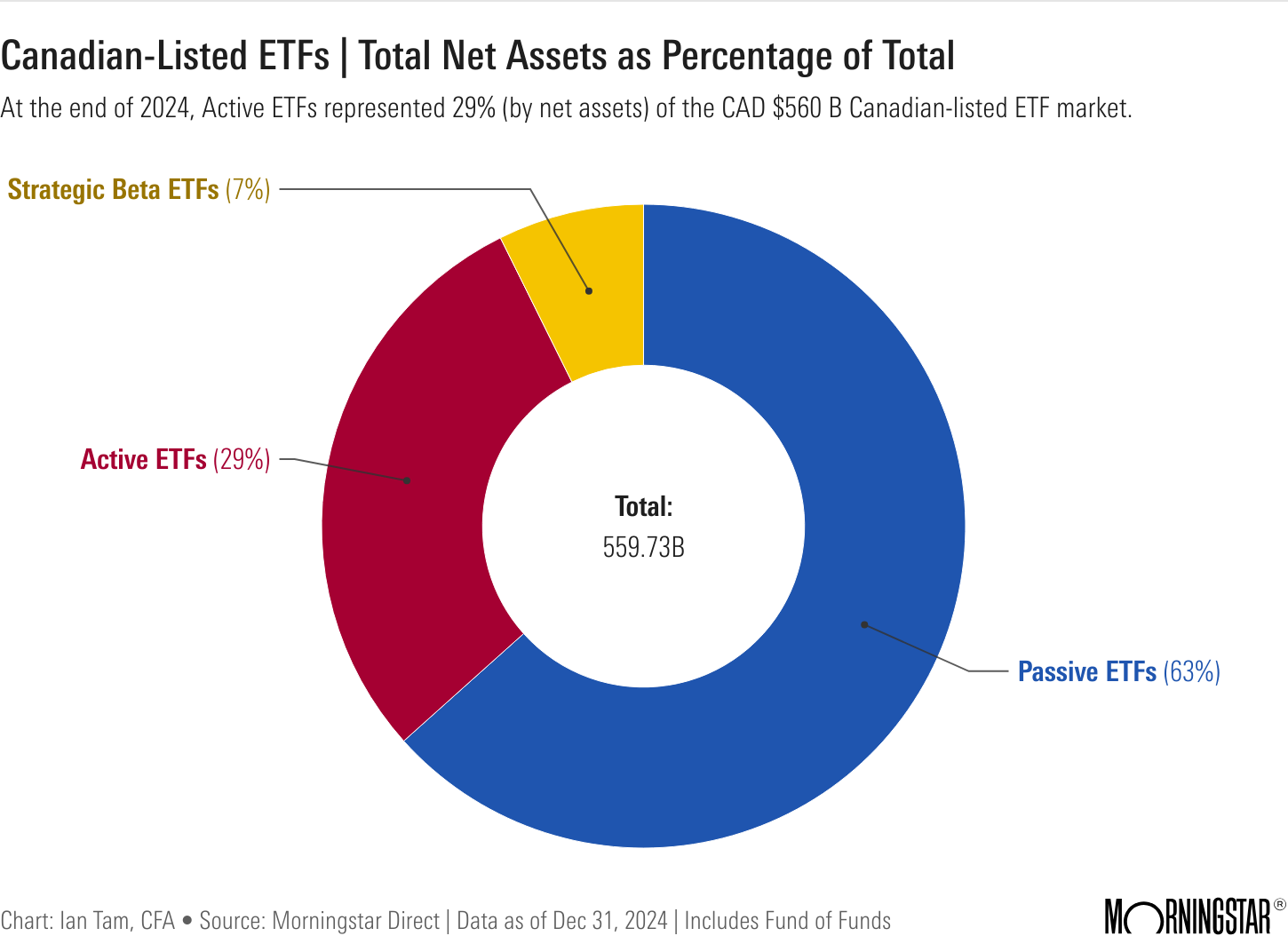

However, assets have not yet caught up. Less than one-third of Canadian-listed ETF assets are housed within actively managed products leaving a large large swath of active ETFs sharing a small slice of a growing pie. This contrasts directly with our neighbors south of the border where passively managed assets now make up more than half of that invested across both mutual funds and ETFs according to Morningstar’s research.

Given Canadians’ propensity to invest actively (either by prescription or by choice), and the preference for transparent exchange traded products, it would not be hard to imagine active ETFs quickly becoming the largest part of the ETF pie in the coming years.

All this said, ‘switching’ to an ETF isn’t always a straightforward decision. Most mutual fund assets in Canada are still held in commission-based share classes, meaning that annual fees paid include costs associated with advice and distribution. Advisors who are compensated in this manner, might be motivated to keep investor assets status quo. Investors who value the advice provided and the advisor relationship might also be more comfortable with staying the course. This, alongside the potential tax implication when redeeming mutual fund units in a non-sheltered account might be barriers that should give an investor some pause.

Assuming you’ve got the above covered, some additional not-so-obvious facts on active ETFs before pulling the trigger:

1. Many popular balanced or “all-in-one” ETFs are considered actively managed because a portfolio manager is determining the mix between asset classes and regional exposures. The components of these products are often low-cost passive ETFs.

2. Consider the asset class you are investing in and whether it warrants an active manager. For example, some would argue that the US stock market is quite efficient. Is the (unlikely) potential of an active manager in this space outperforming the index worth the additional fees paid.

3. ETFs (unlike mutual funds) do not have the optionality to ‘close’ to new investors. This can become an issue when the objective of the fund involves investing in less liquid investments (small caps, for example), leading to potential capacity issues.

The proliferation of active ETFs in Canada provides more choice for investors seeking active management in a low-cost, transparent vehicle. However, the suitability of active ETFs depends on the asset class, fund strategy, and investor preferences. While the growth of active ETFs brings opportunities, thoughtful due diligence is required to determine if paying extra for active management is justified.

This article does not constitute financial advice. Investors are urged to conduct their own independent research before buying or selling any security, fund, or ETF.

Ian Tam, CFA is Director of Investment Research, Canada at Morningstar Research Inc. a wholly-owned subsidiary of Chicago-based Morningstar Inc. Tam is a member of the Ontario Securities Commission's Investor Advisory Panel, and the CFA Institute's ESG Technical Committee.

Discussion