The Value of a Tax Deduction

Last April, I posed the following question publicly on my social media accounts:

"If you could buy $32,000 of RRSP contribution room, how much would you pay for it? Less than $4,000? Or more than $4,000?"

Today we are going to explore that, in depth.

Can you attach a monetary value to RRSP contribution room? It's a hard question to answer.

If you were to ask what the value of a tax deduction is, most often the answer will be related to your effective or marginal tax bracket. The reduction in current year tax payable, if you will.

However, with RRSP contributions it’s not that simple. While you get a tax deduction up front, you also get a tax burden which will stay with you until the RRSP funds are withdrawn.

There is uncertainty in this equation, because nobody knows how the future will unfold. Will the future tax rate on your withdrawal be the same, higher, or lower, then the rate of tax savings on your deduction?

Lets look at the poll results from that time from both X and LinkedIn.

Across both platforms there were 908 votes, with the 2nd option of “more than $4,000” taking 55% of the vote-share.

The comments were... interesting. Here is a snippet with three of the many responses that I received;

On one side of the spectrum, there was a well thought out financial formula. On the other, I was simply called a boomer 😄 (I think for the first time in my life). In-between, there were a variety of replies ranging from troll to quality. It was honestly what you’d expect on X.

(as an aside, this was my first introduction to Brandon Koepke. Since then we've met up in person and have gotten to know each other. Great guy, funny, and incredibly bright, worth a follow if you are on X and interested in finance.... and for those wondering, I have not met up or gotten to know @bells_inthecity)

To my enjoyment, nobody could guess what I was really getting at with the question… more on that to follow.

First, let’s try and tackle that question. Some of the replies approached the question through the lens of tax rate differentials. In other words, if your tax rate when you withdraw from your RRSP is at least 12.5% lower than your tax rate when you made your contribution, then you will have gained at least $4,000. The math on that would be $32k x 12.5% = $4,000... Not a bad way to think about it.

Of course, with time things always become less certain. While you know what your current tax rate is, your future tax rate is unknown. What you would otherwise do with the money, otherwise known as your opportunity cost, is also a factor.

If your TFSA is maxed out, then a RRSP contribution will be worth more to you, because the alternative would then be to invest within a taxable account, which would come with tax-drag.

Tax-drag is the reduction to your rate of return over time, as a result of the tax you have to pay on your dividends, interest, and capital gains. This is relevant to taxable, or non-registered, accounts. You also may have opportunities to split income in after age 65 with a lower income spouse. This can add to the chances that additional RRSP contribution room will add value to you. However, not everyone has a spouse, so that’s the last time I’ll mention that in this post.

What can we pull from this information?

One obvious takeaway is that the monetary value of an incremental dollar of RRSP contribution room will vary for each person. For example, someone who has maxed out their RRSP will attribute value to further contribution room, while someone who has more room than they will ever use would see zero value in having even more room.

So who then will have the most to gain? Who would be willing to spend the most to acquire more RRSP contribution room? And why in the poll did I suggest $32,000 at a cost of $4000?

Those with the most to gain will be those who have:

1. Already maxed out their RRSP, and

2. Already maxed out their TFSA; and

3. Are in a high current marginal tax bracket.

What about the second series of questions? Why did I want to know if you would pay $4,000 for an extra $32,000 of RRSP contribution room?

Well, it’s because this whole time that you thought you were reading a post about RRSPs, you weren’t. This is in fact a sneaky FHSA post, simply disguised as a RRSP post. Sort of how the FHSA can be a RRSP in disguise.

If you are planning to buy a home this year you could open a FHSA (assuming you meet the eligibility criteria) and make a contribution of $8,000 and receive a tax deduction for that amount. Then, when you buy your home, you have up until 30 days after closing to make a qualifying withdrawal from your FHSA.

That’s a withdrawal that ‘qualifies’ to come out of the account tax-free. If you were in a high tax bracket, let’s assume 50%, then that $8,000 tax-free withdrawal has approximately $4,000 of 'tax value' to you. If it had been a taxable withdrawal you would have paid roughly $4,000 in tax on the income inclusion.

But here’s the thing that not many people have really talked about yet. When you buy your ‘first home’ you have the option to make a qualifying tax-free withdrawal from your FHSA... BUT, you also have the option to NOT make a qualifying withdrawal.

Instead, you could keep the account open much longer. If you opt to keep the account open, then - even after you’ve bought a home - you can continue to make additional $8,000 annual TAX DEDUCTIBLE contributions for the next 4 years totaling an additional $32,000 in contributions in the FHSA's 2nd to 5th years.

As a reminder, with the FHSA you can contribute $8,000 per year to a lifetime maximum of $40,000 of contributions. We are talking here about your options if you were to buy a home after making only making the first year's contribution.

Also to clarify, the thing that forces you to close down your FHSA is the act of making a qualifying withdrawal, not the act of buying a qualifying home. If you don’t make a qualifying withdrawal, the FHSA continues to operate as though you didn’t buy a home, even if you did buy a home.

Once you’ve made your $40,000 of tax-deductible contributions you can transfer the entire FHSA including all of the gains into your RRSP. You have up until the end of the 15th year since opening your FHSA account to do this lateral transfer.

So the decision to make is this:

If you buy a home early into your FHSA timeline, do you make the tax-free withdrawal, or don’t you?

Is the approximately $4,000 of tax value on the $8,000 qualifying withdrawal worth more, or less, than $32,000 of additional contribution room? I’ve modeled this out for you in my planning software.

To do this, I had to create a fictitious person who fits the profile described above.

The person is 36 (the avg age of a first-time home buyer in Canada), in the 48.29% tax bracket in Ontario, and plans to work to age 60. Their portfolio is 25% fixed income, 75% equity, which changes to 40/60 at age 55. The rate of return and inflation assumptions are as per the FP Canada guidelines, reduced by 0.8% to account for fees you might pay. Here's a link to those guidelines if you are interested: https://www.fpcanada.ca/docs/default-source/standards/2023-pag—english.pdf?sfvrsn=911e63c0_3. The mortgage and cost of living amounts are such that they still have enough cash to continue to top up their RRSP and TFSA annually, with a bit spilling over into a non-registered account.

We could debate these assumptions forever, it’s just one possibility to begin to think about this.

Before I get into the results, I think an additional comment for further context is warranted, and it’s reason I took this to the level of detail of using my modeling software rather than a simpler tax differential calculation.

I have been fortunate to have worked with many clients, and at all age demographics. Unfortunately, I’ve also now seen many of them pass away. Here’s the thing about most of the ones who would have fit the profile I just described… they typically don’t outlive their money. Instead, usually there are sizeable balances in their registered accounts when they pass away. This is relevant to this analysis.

Given the fact that there is a good chance that the RRSP (or RRIF) will never be fully withdrawn before death, this really becomes an estate question. At the end of the day, how much higher is the after tax-value of your estate going to be if you have the opportunity to contribute an extra $32,000 into your RRSP via your FHSA? To determine this, I ran two scenarios.

The 1st was a baseline (no extra FHSA/RRSP room).

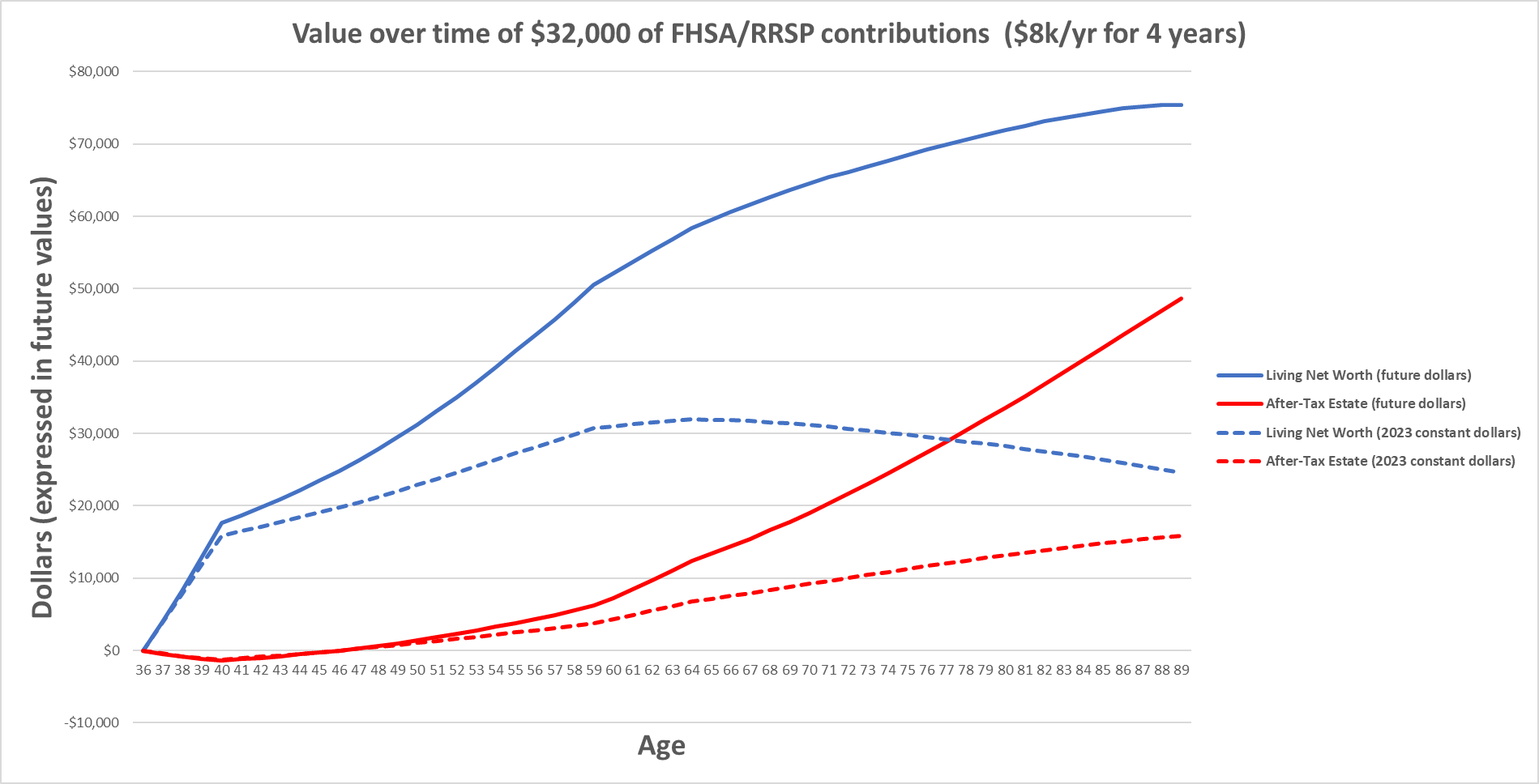

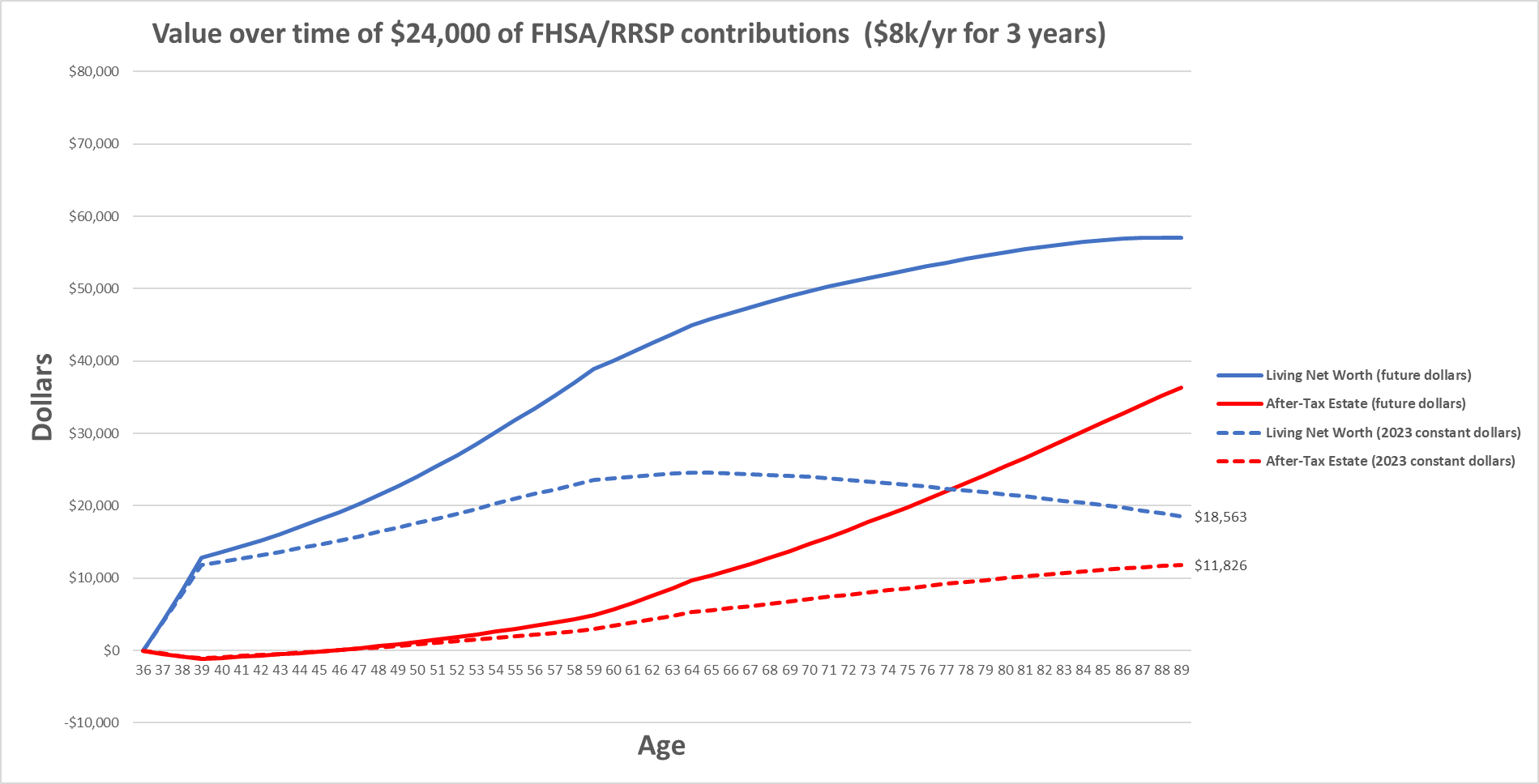

In the 2nd, I factored in the additional FHSA contribution room by $8,000 in years 2, 3, 4, and 5 (due to not taking a qualifying withdrawal). I then compared the results of the two models and have summarized those results in the following chart.

The blue lines relate to your living net worth. This ignores deferred tax liabilities, like the future tax on RRSP or FHSA accounts.

Meanwhile, the red lines relate to the after-tax value of your estate if you were to die in any given year. You can see that in the first 10 years, the additional FHSA contributions result in a higher living net worth, but lower estate values.

This is due to the FHSA or RRSP being exposed to top marginal rate of 53.53% on death, when the contribution only attracted a living value deduction at 48.29%. However, with time, the larger portfolio balances eventually overcome this tax differential.

In year 11 the estate values turn positive and then they never look back.

By age 89, the estate is worth $48,615 more after-tax in the scenario with $32,000 of more FHSA/RRSP contribution room. It's always important to factor in inflation, so discounting that back to 2023 we get a current value of $15,826 (the dotted red line).

In a nutshell, there’s your answer to this bizarre question that I posed.

To summarize: Under the assumptions for this one hypothetical person... $32,000 of FHSA (or RRSP) contribution room is worth just shy of $16,000 at a typical life expectancy. Or, roughly 4 times the ~$4,000 tax value of taking a FHSA qualifying withdrawal of $8,000 in year 1.

That said, please don't confuse this and think this is a strategy for everyone.

Those who have lots of RRSP room, or those who have available TFSA room, or those at lower tax rates… they all are probably still better off to take the qualifying withdrawal as the FHSA was designed for. However, those who are in are in a circumstance similar to the profile that I’ve mentioned above would be wise to consider the benefits of taking the extra contribution room and opting out of a qualifying FHSA withdrawal this year.

If I haven't bored you yet, let's analyze this a little further and dig into the natural progression of this line of thinking.

For every additional year of FHSA contributions you make, the more value your qualifying withdrawal will hold.

Per the above, an $8,000 qualifying withdrawal is worth $4,000 in tax-value if it comes out tax-free, assuming a 50% marginal tax rate. Following the same logic, if you have $16,000 in your FHSA, then the qualifying withdrawal is worth $8,000... $24,000 is worth $12k... and so on.

Those are the contribution amounts only, remember there will be an unknown market return element as well. As the balance of your FHSA goes up, and the fewer remaining possible contributions go down, the value of the above outlined strategy will diminish.

Ignoring investment returns, I have ran the model to consider how the numbers change if you were to buy the house one or two later than what I outlined above.

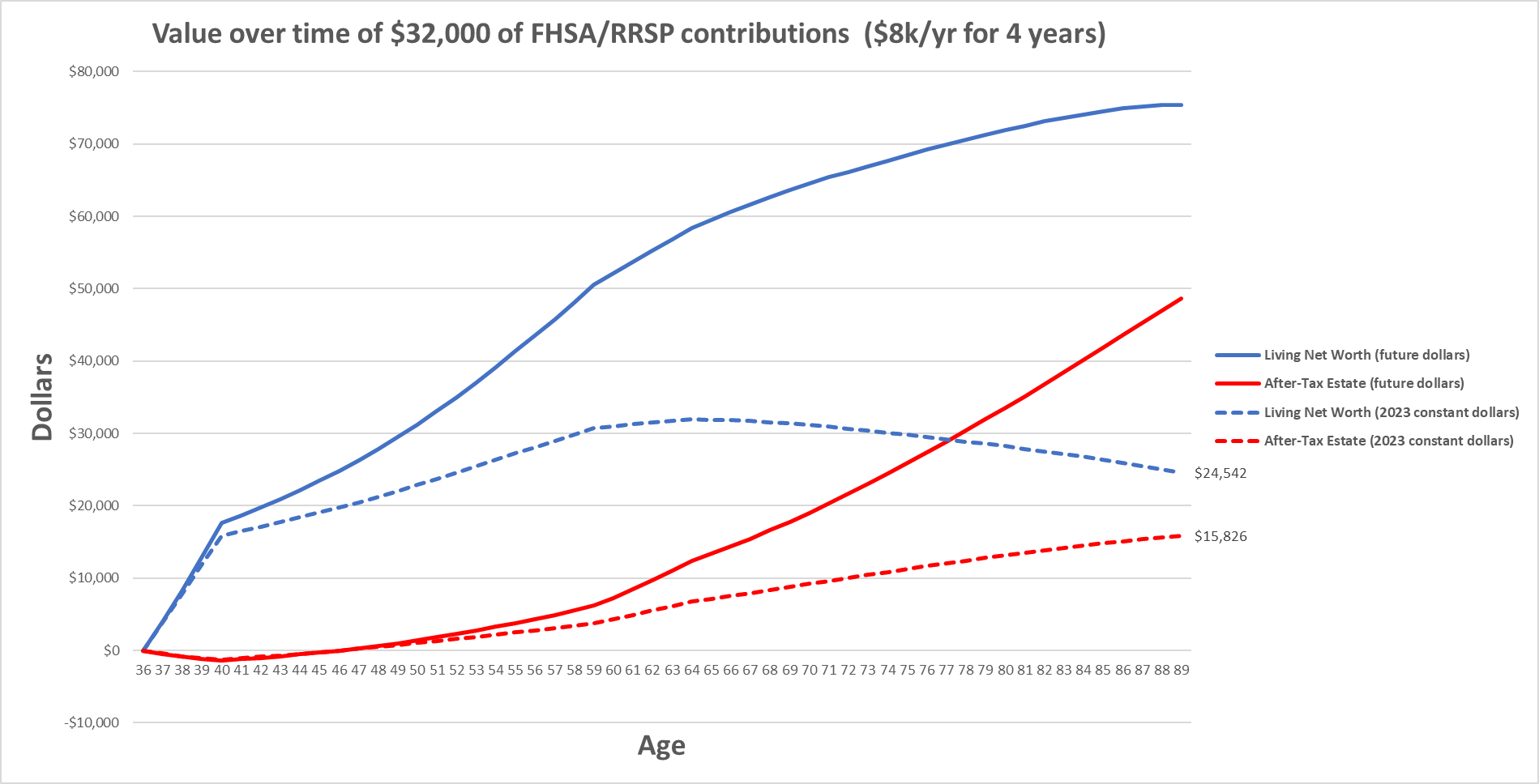

First, let's look again at the original chart from above so it is fresh in your memory.

Next, let's look at the same analysis, but change the details so that we are now considering whether keeping the FHSA open after already making two years of contributions would make sense. In this example we are now comparing the value of an extra $24,000 of future contribution against $8,000 of tax value resulting from making a $16,000 qualifying withdrawal.

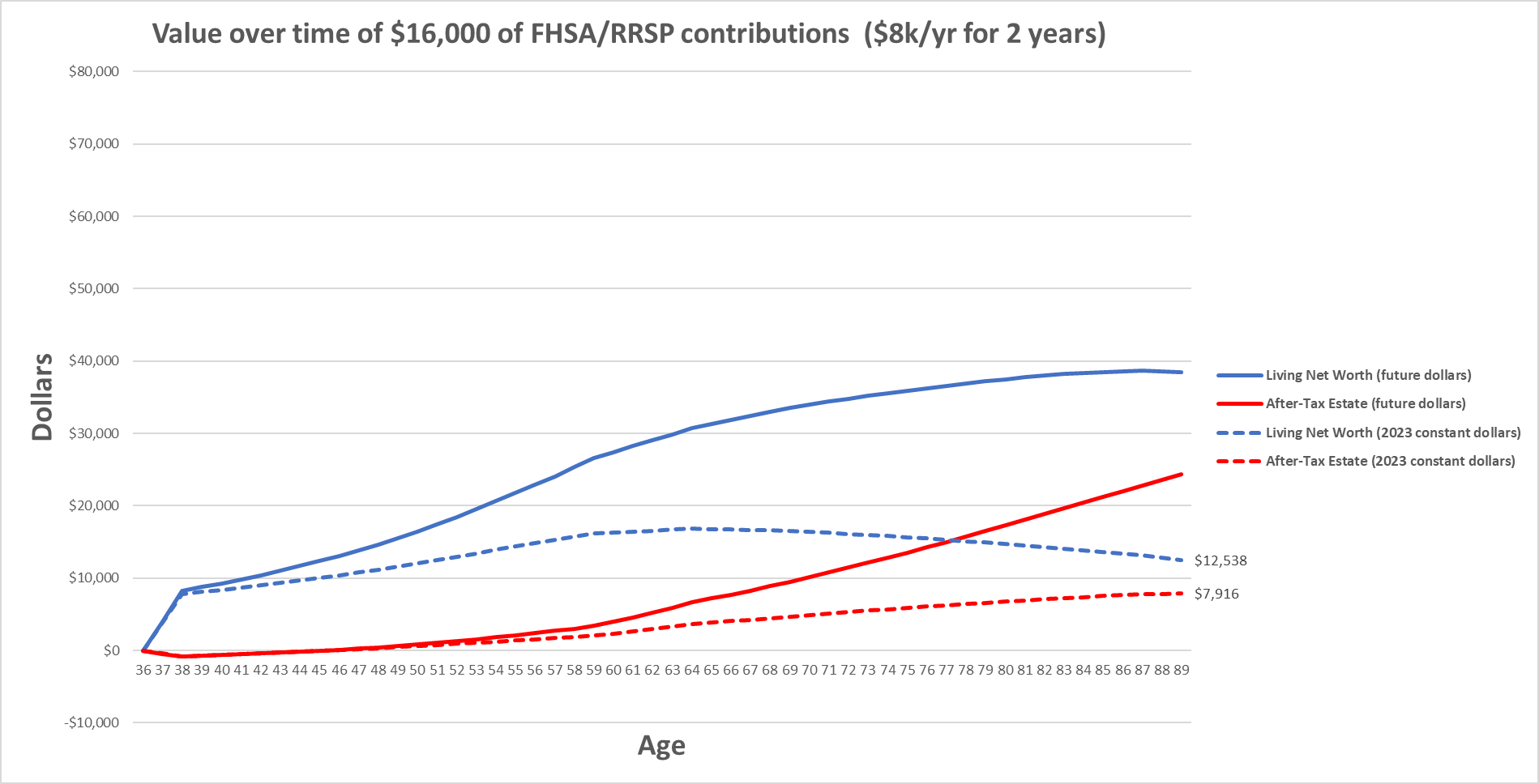

Now let's look at this after already having made three years of contributions. In this example we are now comparing the value of an extra $16,000 of future contribution against $12,000 of tax value resulting from making a $24,000 qualifying withdrawal.

That last one doesn't make sense anymore, so I don’t think it’s worth my time, or your time, considering anything further beyond that.

The FHSA is still new. It's unique and different to the other investment accounts available in Canada, just like you and your financial situation is unique to those of other Canadians. It's important to think of how best you can use the financial tools available to you, to maximize the value to you over your lifetime, even if the strategy is a little outside the normal box.

Discussion